The COVID-19 pandemic sent shock waves through the world economy and triggered the largest global economic crisis in more than a century. The crisis led to a dramatic increase in inequality within and across countries. Preliminary evidence suggests that the recovery from the crisis will be as uneven as its initial economic impacts, with emerging economies and economically disadvantaged groups needing much more time to recover pandemic-induced losses of income and livelihoods.1

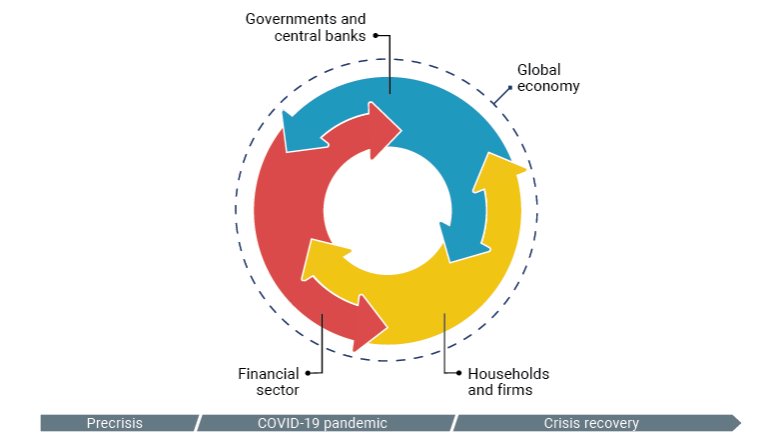

In contrast to many earlier crises, the onset of the pandemic was met with a large, decisive economic policy response that was generally successful in mitigating its worst human costs in the short run. However, the emergency response also created new risks¡ªsuch as dramatically increased levels of private and public debt in the world economy¡ªthat may threaten an equitable recovery from the crisis if they are not addressed decisively.

Worsening inequality within and across countries

The economic impacts of the pandemic were especially severe in emerging economies where income losses caused by the pandemic revealed and worsened some preexisting economic fragilities. As the pandemic unfolded in 2020, it became clear that many households and firms were ill-prepared to withstand an income shock of that scale and duration. Studies based on precrisis data suggest, for example, that more than 50 percent of households in emerging and advanced economies were not able to sustain basic consumption for more than three months in the event of income losses.2 Similarly, the average business could cover fewer than 55 days of expenses with cash reserves.3 Many households and firms in emerging economies were already burdened with unsustainable debt levels prior to the crisis and struggled to service this debt once the pandemic and associated public health measures led to a sharp decline in income and business revenue.

The crisis had a dramatic impact on global poverty and inequality. Global poverty increased for the first time in a generation, and disproportionate income losses among disadvantaged populations led to a dramatic rise in inequality within and across countries. According to survey data, in 2020 temporary unemployment was higher in 70 percent of all countries for workers who had completed only a primary education.4 Income losses were also larger among youth, women, the self-employed, and casual workers with lower levels of formal education.5 Women, in particular, were affected by income and employment losses because they were likelier to be employed in sectors more affected by lockdown and social distancing measures.6

Similar patterns emerge among businesses. Smaller firms, informal businesses, and enterprises with limited access to formal credit were hit more severely by income losses stemming from the pandemic. Larger firms entered the crisis with the ability to cover expenses for up to 65 days, compared with 59 days for medium-size firms and 53 and 50 days for small and microenterprises, respectively. Moreover, micro-, small, and medium enterprises are overrepresented in the sectors most severely affected by the crisis, such as accommodation and food services, retail, and personal services.

The short-term government responses to the crisis

The short-term government responses to the pandemic were extraordinarily swift and encompassing. Governments embraced many policy tools that were either entirely unprecedented or had never been used on this scale in emerging economies. Examples are large direct income support measures, debt moratoria, and asset purchase programs by central banks. These programs varied widely in size and scope (figure 1.1), in part because many low-income countries were struggling to mobilize resources given limited access to credit markets and high precrisis levels of government debt. As a result, the size of the fiscal response to the crisis as a share of the gross domestic product (GDP) was almost uniformly large in high-income countries and uniformly small or nonexistent in low-income countries. In middle-income countries, the fiscal response varied substantially, reflecting marked differences in the ability and willingness of governments to spend on support programs.

Figure 1.1 Fiscal response to the COVID-19 crisis, selected countries, by income group