Investment in education critical to address significant learning gaps, foster sustainable growth, report finds.

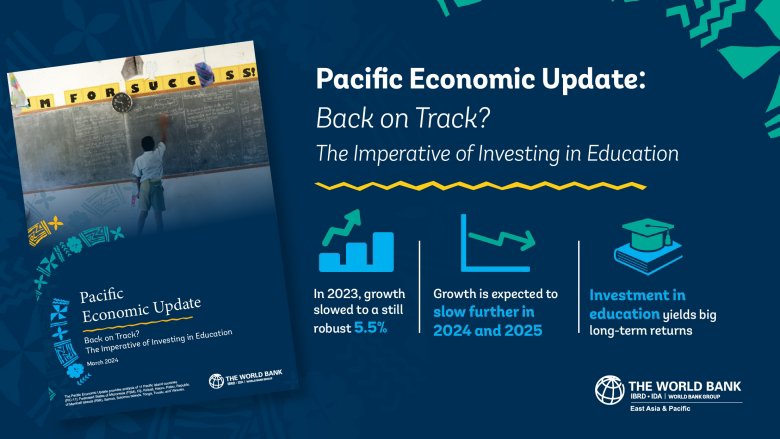

SUVA, March 6, 2024�� Growth in Pacific island countries is estimated to have slowed in 2023 and is forecast to continue to decelerate in 2024 and 2025 as the temporary boost from the COVID-19 pandemic recovery fades and fiscal policies begin to tighten, the World Bank said in its semi-annual economic outlook for 11 Pacific island countries.

Investments in key drivers of long-term growth��education, in particular��will be crucial to sustaining economic momentum, the World Bank��s new report, Pacific Economic Update �C Back on Track? The Imperative to Invest in Education says.

Growth in 2023 among the Pacific island countries surveyed eased to an estimated 5.5% following a historically high expansion of 9.1% during 2022, the first year of recovery from the pandemic. Economic activity was buoyed by tourism, household consumption and remittances, and was further supported by accommodative fiscal policies. The report covers Federated States of Micronesia (FSM), Fiji, Kiribati, Nauru, Palau, Marshall Islands, Samoa, Solomon Islands, Tonga, Tuvalu, and Vanuatu.

Collectively, these countries are projected to expand 3.5% in 2024 and 3.3% in 2025, which would still be the fastest rates since 2017, excluding the pandemic bounce-back expansions in 2022 and 2023.

Moderating growth across Pacific island countries in 2023 reflects the slowdown in still-resilient Fiji, which accounts for more than half of the group��s output. Fiji is estimated to have decelerated to 8% in 2023 after surging 20% in 2022. After having returned to pre-pandemic GDP levels in 2023, supported by the resurgence of tourism and robust consumption, Fiji��s growth is expected to normalize toward its long-term rate.

In the rest of the region, a slight acceleration in growth is anticipated. However, the output is not expected to exceed its pre-pandemic GDP level until 2025. Solomon Islands, the second-largest economy in the group, is estimated to have reversed a 4.1% contraction in 2022 with 1.9% growth last year, driven by hosting the Pacific Games and substantial investments in energy and transport. It is forecast to pick up to 2.8% in 2024.

��Despite a commendable rebound in growth after lifting pandemic restrictions, growth among the PIC-11 countries will face challenges in achieving the full recovery of output growth to its pre-pandemic path,�� said World Bank Senior Economist in the Pacific, Ekaterine Vashakmadze. ��Fundamental reforms to invigorate investment growth can help improve medium-term growth prospects.��

Tourism and remittances-led countries, such as Samoa, Tonga, and Palau have experienced a notable rebound in growth after three consecutive years of contraction. This revival is attributed to a robust recovery in visitors, particularly from Australia and New Zealand. Countries [with income led] by sovereign revenue��Kiribati, Nauru, Tuvalu, FSM and Marshall Islands��experienced a relatively mild contraction in 2020 and are now experiencing positive, albeit moderate growth.

The report underscores the significance of pending Compact Agreements between the United States and FSM, Marshall Islands, and Palau to achieve projected growth rates. If approved, these agreements could create substantial fiscal space, presenting an opportunity for more public investment initiatives.

Short term risks to the outlook have been more balanced as commodity prices and inflation have eased.

��However, risks remain as adverse shifts in the global economy, trade, and tourism may pose challenges to the economic prospects and poverty outcomes. Those could stem from an uncertain global environment, most notably, heightened geopolitical tensions,�� added World Bank Senior Economist Reshika Singh.

A special focus chapter on developing human capital in the Pacific emphasizes that investment in education �C through quality and well-resourced, evidence-based teacher training, and ensuring that children are taught in their first language �C can deliver immense economic dividends for individuals, families, and society. In Tonga, for example, teacher training investments were found to increase students�� future incomes by more than $12 for every dollar spent.

However, in most Pacific Island countries, more than half of 10-year-olds do not meet international benchmarks in reading. In some countries (Kiribati, Tonga, and Tuvalu) two-thirds of 10-year-olds fall short of these standards. A notable exception is Palau, where 90% of 10-year-olds meet international benchmarks in reading.

��If Pacific children struggle to read proficiently by the end of primary school, they will face daunting hurdles to succeed in their further education,�� said World Bank Lead Economist for Human Development in the Pacific, Lars M. Sondergaard. ��While the situation is improving, progress is slow. The most important asset that Pacific island countries have is not their natural or physical resources, or their geographical location; it is their people.��

Pacific Economic Update �C Back on Track? The Imperative to Invest in Education is available online.