That¡¯s quite a range for different countries. How do CCDRs estimate investment needs?

CCDRs use different methodologies depending on what is most relevant to each country. This approach positions CCDRs to support policy debates and prioritization in a given country, although it does make it more challenging to aggregate and compare results.

Having said that, there are some common starting points for all CCDRs: the investment needs we identify represent additional investments needed by 2030 to boost resilience, finance adaptation, and enable countries to undertake low-carbon development. But it is the reference used to define the ¡°additionality¡± of these investments that differs across CCDRs, since this is largely depending on the development context in each country. That is because CCDRs are focused not only on climate change, but on the interplay between climate change and development.

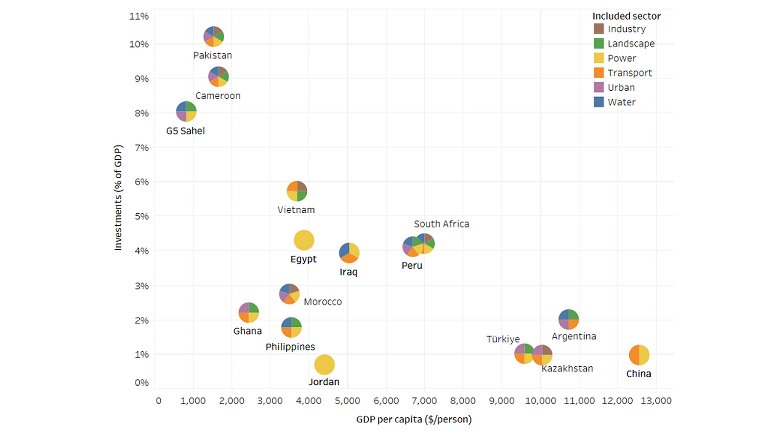

In many UMICs, such as China and T¨¹rkiye, we¡¯ve defined additional investment needs as the difference between a resilient and low-carbon development scenario and a business-as-usual development scenario. These needs are based on the country¡¯s development priorities, but without the same objectives in terms of resilience and greenhouse gas (GHG) emissions. On the mitigation side, estimates include investments in greener solutions, such as renewable energy, but also ¡®negative costs¡¯ from investments that are no longer needed, such as coal power plants or natural gas infrastructure. On the adaptation and resilience side, estimates include the incremental cost of building more resilient infrastructure, not the full cost of the assets. The relatively small additional investment needs for resilient and low-carbon development in UMICs suggest that, in these countries, aligning development and climate magnifies the financing challenges they face, but only moderately.

In most LICs and LMICs, such as Pakistan or the Sahel countries, identified investments go to boost resilience and close existing development and infrastructure gaps, such as lack of access to improved water or modern energy, using the best available technologies to do so. For instance, the Sahel CCDR does not explore how to provide green, resilient energy access to the same number of people, as in a business-as-usual scenario, but rather the investments needed to provide more people with access to green and resilient electricity. CCDRs in LICs and LMICs tend to compare investment needs for a resilient and low-carbon pathway against current investment levels but achieve much better development outcomes than simply continuing current trends. The ¡®additional investments¡¯ therefore include investments in greener and more resilient solutions but also investments needed to close existing development and infrastructure gaps (and they are not ¡®net¡¯ of non-needed investments). The large additional investment needs in LICs and LMICs show the large financial challenge these countries face to achieve their development goals in a resilient and sustainable way.

Can you dive a bit deeper and explain how CCDR estimates compare with global estimates of climate finance needs?

Sure, let¡¯s focus on global estimates from and a .

The uses country-level-data from as well as top-down studies for major categories of climate investments to estimate investment needs in emerging markets and developing countries. It builds on previous assessments, including work of the ) and the , as well as on the adaptation-side work by the . The report finds that around $1 trillion per year is needed by 2025, and $2-2.8 trillion by 2030, for emerging markets and developing countries other than China. These are total investments (including both development and climate-related needs) while additional investments (climate-related needs only) are estimated at $1.2-1.7 trillion per year by 2030 (with a similar ratio, it puts the 2025 climate related needs at $600 billion).

estimates the total cost of closing infrastructure service gaps by 2030 in water and sanitation, transport, electricity, irrigation, and flood protection. One of the explored scenarios is consistent with net zero emissions by 2050 and includes ambitious policy reforms to reduce investment needs and maximize the efficiency of spending. In this scenario, closing the infrastructure gap would cost $1.5 trillion per year by 2030 in capital investments in developing countries (or 4.5% of GDP on average). Without the accompanying reforms, the total cost would increase to 8% of GDP.

The challenge, however, is that these estimates cannot be directly compared with CCDR estimates because they are global, while the sample of CCDR countries is not representative of global needs, and because they use different scopes, baselines, and mitigation and adaptation scenarios.

However, extrapolating CCDR results using the average investment needs by 2030 per income group yields some interesting results. With this simple approach, and being mindful of the differences in methodologies, we estimate annual climate-related investment needs for all low- and middle-income countries other than China at $783 billion per year between now and 2030. This is higher than estimates for 2025 ($600 billion), but significantly lower for 2030 ($1.2-1.7 trillion). It is also lower than estimates ($1.5 trillion by 2030). So why do we see this difference between the CCDR-based estimates and the global estimates? A few reasons:

First, there are differences in scope and baseline. Estimates from the and reports are focused on full investment costs to achieve development goals and climate objectives. As mentioned before, CCDRs are focused on the interplay between climate and development and have used different baselines, depending on what appeared most useful and relevant in different countries.

CCDRs and the global reports differ the least in LICs and LMICs where most of the additional investment needs identified in CCDRs would be required with or without climate change. That helps explain why estimates for these countries (5.1% in LMICs and 8.0% in LICs) are close to those identified in the global reports but differ more for UMICs (1.1%).

Second, there are differences in ambition of the scenarios. Consequently, the ambition of the scenarios for mitigation and adaptation differ from most global studies, which apply a more uniform top-down approach.

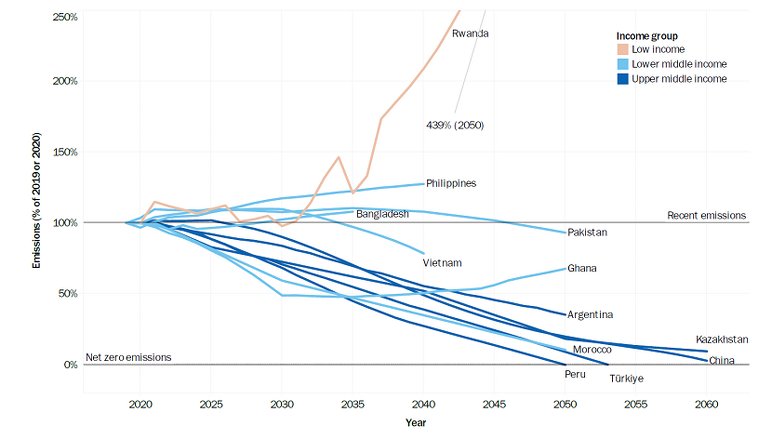

For emission reductions, the first batch of CCDRs presents illustrative pathways that achieve about 70% emissions reductions in the considered countries by 2050, with residual emissions totaling 5 GtCO2e (see figure 2 which shows the emissions pathways for a subset of the CCDRs). Global assessments, such as and , on the other hand, are typically demand driven and top-down: they calculate what is needed to achieve net zero emissions but without the same focus on absorption capacity issues, implementation challenges, and political willingness and feasibility. If we scale up linearly the $783 billion annual investments to achieve net zero instead of 70% emissions reductions¡ªnoting that the incremental costs of the last 30% are likely higher¡ªthe annual investment needs for all low- and middle-income countries other than China would exceed $1 trillion, very close to global estimates.