The Lao economy faces increased challenges from a sharp currency depreciation and high inflation, amid a deteriorating global economic environment and slow domestic reforms. Following signs of economic recovery in early 2022, the domestic and external environment has deteriorated significantly. The kip lost 68 percent of its value against the US dollar over the year to October, undermining recovery and fueling inflation, which in turn dampens private consumption and investment. ŷ����b��Ƭ has lowered its economic growth forecast for 2022 to 2.5 percent, down from an earlier projection of 3.8 percent.

�� Although employment had risen by mid-2022, earnings did not keep pace with inflation. Year-on-year consumer price inflation had risen to 37 percent by October 2022, with food price inflation at almost 39 percent. This particularly affects the urban poor, with some families forced to reduce their consumption of food and fuel. Two-thirds of households report spending less on health and education, which could undermine long-term human development.

�� Fiscal options for supporting the economy and vulnerable people remain limited. Domestic revenue has gradually recovered but remains below pre-pandemic levels. High debt-service obligations constrain public spending on health, education, and social assistance. In the absence of debt payment deferral, total expenditure and the fiscal deficit would be about 1 percent of GDP higher.

�� Debt sustainability hinges on successful negotiations with major bilateral creditors. Public and publicly guaranteed debt reached $14.5 billion at the end of 2021 and, with the kip depreciating, is projected to increase to over 100 percent of GDP within 2022. Contingent liabilities from state-owned enterprise non-guaranteed debt and public-private partnerships are also a source of concern. Debt service deferrals between 2020 and 2022 have provided temporary relief, with accumulated deferred payments reaching around 8 percent of 2022 GDP. Debt service obligations average $1.3 billion per year for 2023-26, or close to the total stock of official foreign reserves recorded in June 2022.

�� The medium-term outlook assumes gradual recovery in international tourism and exports, and is also dependent on successful debt negotiations. Fiscal adjustment, such as through additional expenditure cuts, will not be sufficient to improve debt sustainability without harming long-term growth prospects. In addition, the economic outlook is subject to significant downside risks, including the protracted impacts of the war in Ukraine, rising geopolitical tensions, and tighter global macroeconomic policies such as rising interest rates and the withdrawal of COVID-19 related support. Weaker growth prospects in China, a key trading and investment partner, could also weigh on the recovery.

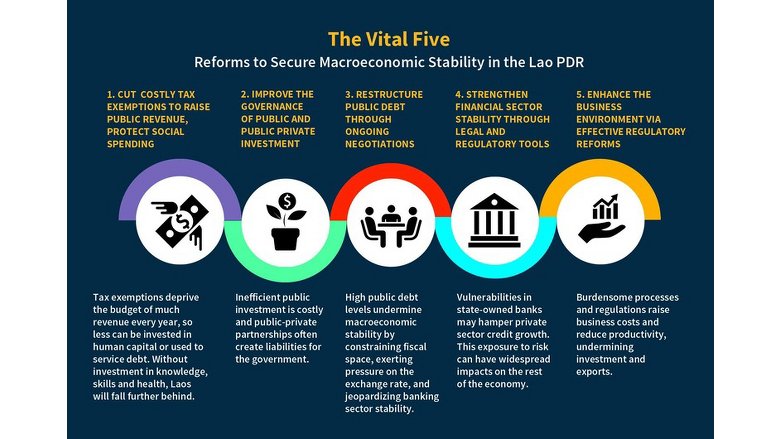

�� Strong commitment to ambitious reform is essential if Laos is to restore economic stability and sustain growth. ŷ����b��Ƭ and other development partners recommend five vital reforms: (i) cutting costly tax exemptions to raise public revenues and protect social spending; (ii) improving the governance of public and public-private investment, and of state-owned enterprises; (iii) restructuring public debt through ongoing negotiations; (iv) strengthening financial sector stability through legal and regulatory tools; (v) improving the business environment and promoting exports through effective regulatory reforms.